While $4529 Tax Refund Australia 2024 means a lot, and an Australian tax refund is a wonderful thing to have, the sum depends on many standpoints: the income, deductions, as well as the tax paid during the year.

This is a genuine 2024 update of the current $4,529 Tax Refund in Australia Claim as ATO sets a new Stage 3 Cuts. For these new Stage 3 tax cuts the taxpayers can claim for $4529 tax refund.

Many are waiting on the Tax Refund Australia 2024 worth $4529, and if you’re unsure whether you would be able to qualify for this big refund, you should continue reading.

Understanding Your $4529 Tax Refund Australia 2024 Eligibility criteria

To qualify for the $4529 Tax Refund Australia 2024, you’ll need to meet several criteria:

Income Requirements:

- Earned taxable income during 2023-24 financial year

- Filed returns before the October 31, 2024 deadline

- Have paid more tax than required through PAYG

Documentation Needed:

- Payment summaries

- Work-related expense receipts

- Investment income statements

- Health insurance details

Remember, not everyone gets exactly $4529 – this is just the average amount thats being refunded in 2024.

The Australia Tax Refund before the stage 3 tax cuts

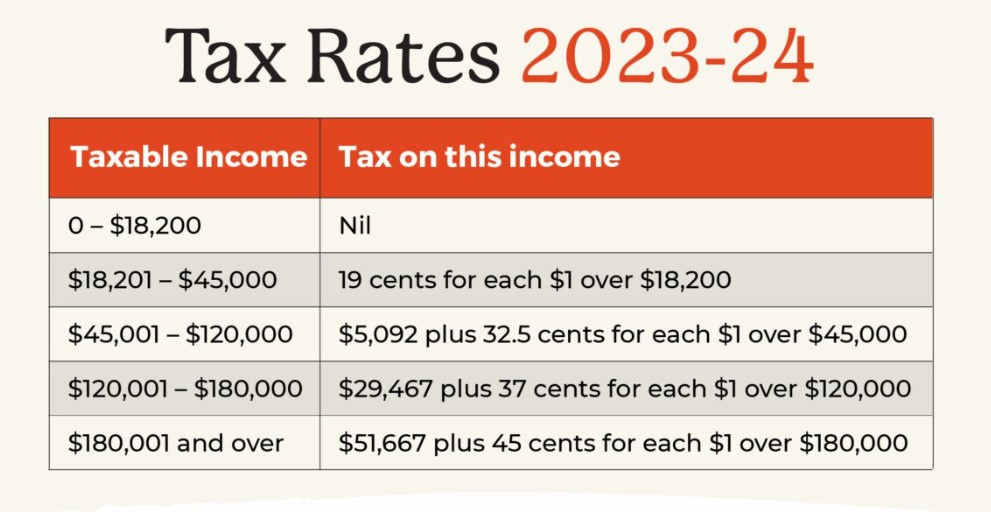

Tax table for tax year 2023-24

| Bracket | Income range | Marginal Tax Rate | Tax payable |

| 1 | $0 – $18,200 | 0% | Nil |

| 2 | $18,201 – $45,000 | 19% | 19% of excess over $18,200 |

| 3 | $45,001 – $120,000 | 32.5% | $5,092 + 32.5% of excess over $45,000 |

| 4 | $120,001 – $180,000 | 37% | $29,467 + 37% of excess over $120,000 |

| 5 | $180,001+ | 45% | $51,667 + 45% of excess over $180,000 |

Redistribution of tax cuts (excluding Medicare Levy)

| Taxable Income | Tax cut under original stage 3 | Tax cut under revised stage 3 | Difference |

| $20,000 | $0 | $0 | $0 |

| $30,000 | $0 | $354 | $354 |

| $40,000 | $0 | $654 | $654 |

| $50,000 | $125 | $929 | $804 |

| $60,000 | $375 | $1,179 | $804 |

| $70,000 | $625 | $1,429 | $804 |

| $80,000 | $875 | $1,679 | $804 |

| $90,000 | $1,125 | $1,929 | $804 |

| $1,00,000 | $1,375 | $2,179 | $804 |

| $1,20,000 | $1,875 | $2,679 | $804 |

| $1,40,000 | $3,275 | $3,729 | $454 |

| $1,60,000 | $4,675 | $3,729 | -$946 |

| $1,80,000 | $6,075 | $3,729 | -$2,346 |

| $2,00,000 | $9,075 | $4,529 | -$4,546 |

| $2,50,000 | $9,075 | $4,529 | -$4,546 |

$4529 Tax Refund Australia 2024 Payment Date

The Australian Taxation Office (ATO) has streamlined their processing times:

E-lodgments: 14-28 days processing time

Paper lodgments: 6-8 weeks processing time

Complex returns: May take up to 90 days

How to Check Your $4529 Tax Refund Australia 2024

Tracking your $4529 Tax Refund Australia 2024 has become easier than ever with the ATOs enhanced digital services.

Quick Access Methods

Through myGov Portal:

- Log into your myGov account

- Connect to ATO services

- Click “Tax” then “Refund Status”

- View estimated payment date

ATO Mobile App:

- Download latest version

- Sign in with myGov details

- Select “Track My Return”

- Enable push notifications

Online Tracking Steps

Access Your Account

- Visit my.gov.au

- Enter login credentials

- Use two-factor authentication

- Select ATO services

Navigate to Refund Section

- Choose “Tax”

- Select “Payments and Refunds”

- Click “Refund Status”

- Review current status

The Australia Tax Refund in 2024 Amount ?

Breaking Down Australian Tax Refund Amounts. The refund amount varies based on several factors:

Standard Deductions:

- Work-from-home expenses: Up to $1,200

- Vehicle expenses: 78 cents per kilometer

- Professional development: Full amount

- Uniform and protective gear: Actual costs

Special Considerations for 2024:

- COVID-19 related expenses

- Digital device depreciation

- Home office equipment

- Professional subscriptions

FaQ of $4529 Tax Refund Australia 2024

(Qus): Is the $4529 tax refund guaranteed?

No, its an average amount. Your actual refund depends on your individual circumstances.

(Qus): When is the deadline to file for 2024?

October 31, 2024, unless youre using a registered tax agent.

(Qus): Can I track my refund status?

Yes, through your myGov account or ATO app.

(Qus): What if my refund is less than $4529?

This is normal as refund amounts vary based on individual tax situations.

Great post! I think my readers would also appreciate this perspective..